The housing market is crashing! Or is it? Thank you Mark Zuckerburg, Jack Dorsey, Donald Trump, WordPress, and TikTok for empowering the world to convince itself that everything and nothing is true all at the same time. What a time to be alive.

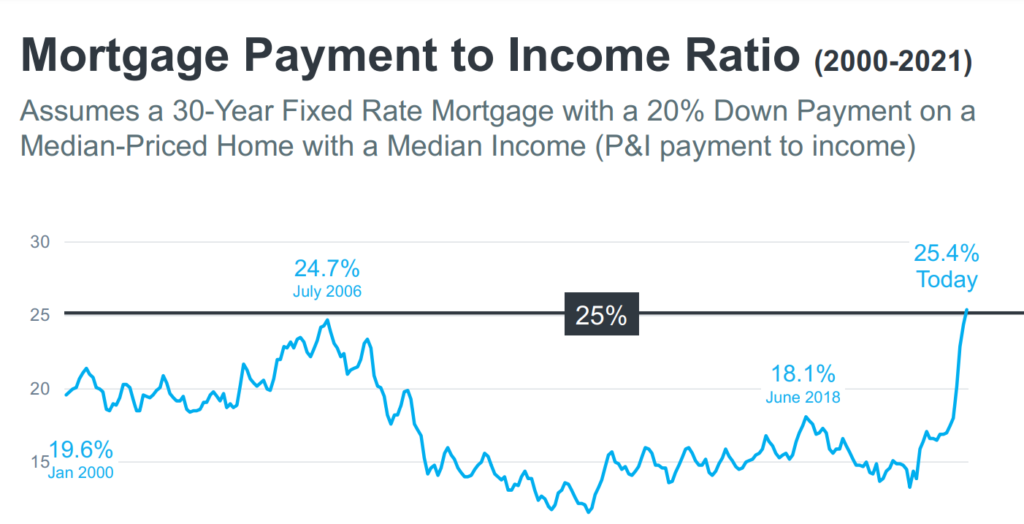

Depending on who you talk to the sky may or may not be falling at the moment for housing. One truth is unavoidable for all. The rates are too damn high!

This may (or may not) be the start of a potential gridlock in housing where people refuse to give up their sweet old rate/payment leading to stagnation of inventory growth which also can equal a floor on prices preventing declines big enough to attract enough buyers back into the game.

The sad irony is that all those buyers waiting for houses to get cheap again literally missed the window. (whoops)

So what’s a buyer, seller, agent, and loan officer to do in a time like this? Take up fly fishing and wait for Jerome Powell to throw us a bone again? Likely that’s exactly what some will do. The rest of us (myself included) will do something slightly more productive and take this time to focus, build, and make deals happen.

The Rise of The Macro-Bro

One of the most fundamental shifts in the world of investing that I’ve been able to witness in my relatively short time on this earth is the growing trend toward a macro-mindset. Efficient market theory may have temporarily collapsed under the weight of Long-Term Capital’s hubris, but from its ashes came the rise of ETF trading and the mindset to go with it.

If markets are so efficient and one can’t find an edge what’s any self-respecting narcissist who thinks they’re smarter than the average bear supposed to do? Become a macro-bro.

Suddenly a huge number of people who can’t seem to beat the S&P (and have a twitter account) know more about what China is going to do better than the Chinese government. With the ease and liquidity that allows virtually anyone to play entire markets via ETF’s we’ve seen a growing trend toward a common mentality that glorifies thinking and investing at a 30,000 foot altitude than one that’s on the ground. (the meme-stock craze being a short and entertaining break).

Real Estate Really Is Local. (Seriously)

The biggest problem with the Macro-Bro mindset is that it ironically for many makes the world such a small and simple place to live in. Real estate is down therefore don’t buy real estate right?

A quick glance in my backyard market (Greenville, SC) demonstrates the far more complex situation. Despite all the doom and gloom homes posted as sold in the last 14 days are mostly selling at list price and in very short/reasonable turn times. Yet just like all markets at the moment; there are tons of listings starting to sit and plenty of 5-10% price reductions happening to those listings.

What do the houses selling quickly and at full price despite the rate hike have in common? They’re great houses with great marketing. Solid locations, good size/value, attractive features/finishes, and listing agents who respect their clients and their profession with top-notch photos, descriptions, and marketing.

A Macro-Bro could never stoop to such a level as to analyze the photos of a particular home. They need to know the trend for Greenville as a whole, how it fits into the U.S. Housing trends and what the current state of the currency and the pending European gas crises will mean for all of this. If you only look at the forest you’ll never chop down a tree.

Real Estate Is About Deals and Deal Making

How can one find success in what looks to be a potentially confusing, gloomy, and uncertain macro-market? Focus on your next deal.

As a real estate investor what attracted me and my capital slowly away from the world of Stocks, ETFs, and Options was the limitless creativity of making a deal. This is the creativity that your typical Macro-Bro just can’t comprehend.

123 Main Street may have a cap rate of only 4% but what if you could find a better use for the land? What if that land is in an opportunity zone and no one has utilized that designation? What if 123 Main Street’s property manager Tony has been asleep at the wheel for the last decade and the rents haven’t been raised accordingly? What if your favorite uncle gave you a below-average rate loan to buy 123 Main because he has too much cash that’s being eaten by inflation?

A Macro-Bro mindset is to invest in a market and hope their predictions come true. A deal-maker’s mindset is to find opportunities that exist or create ones where they don’t. This is what’s going to separate the best from the rest over the next couple of uncertain months.

Agents who find creative ways to market their listings to the right audiences will find themselves buyer. Investors who see the potential to turn a shabby 3/1 into a nice 2/2 will generate above average cash-flows, etc.

Macro trends are immensely important and impactful for market participants to know, follow, and understand; but at the end of the day what really matters is the deal that happens today. The price, terms, and circumstances of that transaction will be what determines its ROI if it’s an investment or its enjoyment if it’s your next home.

If you’re looking for an opportunity it’s time to zoom in.

Recent Comments