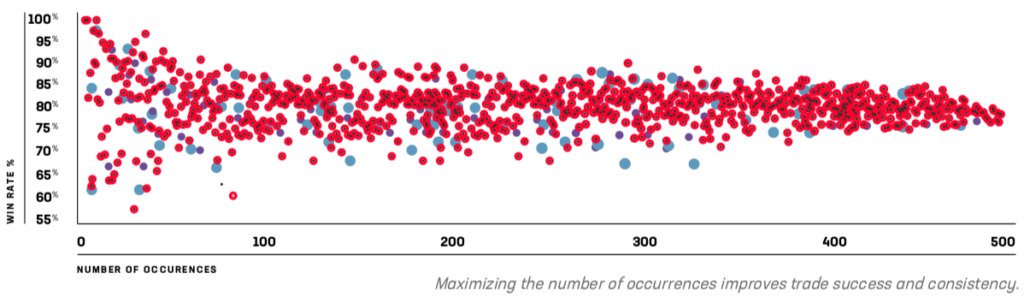

Source: Tasty Trade Financial: This chart displays making high probability trades over a large number of occurrences. Note that the dots cluster and tighten as the volume increases. This is our probability becoming realized. Download their e-book here.

I’ve got a new obsession. Options trading. I’m not a millionaire, and I’m not planning to quit my day job, but frankly I’ve become a bit obsessed. Why? Options give me a gratification that I haven’t had since my days as a full time affiliate marketer managing thousands in advertising spend. That gratification is the ability to learn through decision making.

I’ve read a lot of books over the past year about the subject of forecasting, probability, and data analysis. (I’ll list them with links in the TL;DR summary). If I had to pick one to recommend it would be “Thinking in Bets” by professional poker player Annie Duke. Annie’s wonderful and easy to read book spells out a life lesson from Poker that can be applied to just about anything.

(my paraphrasing) “We grow and improve by focusing on improving our decision making process not just the outcomes”

Annie refers to this as “Resulting” where we judge, and measure our progress purely by the end result, and not the process itself. In her world of poker “bad beats” happen. You make the smart bet. The one with the 98% chance of winning, and sometimes your opponent catches that card on the river. The 2% outcome. This result today is not favorable, but given the chance to make that choice over and over again thousands of times would you make the same bet?

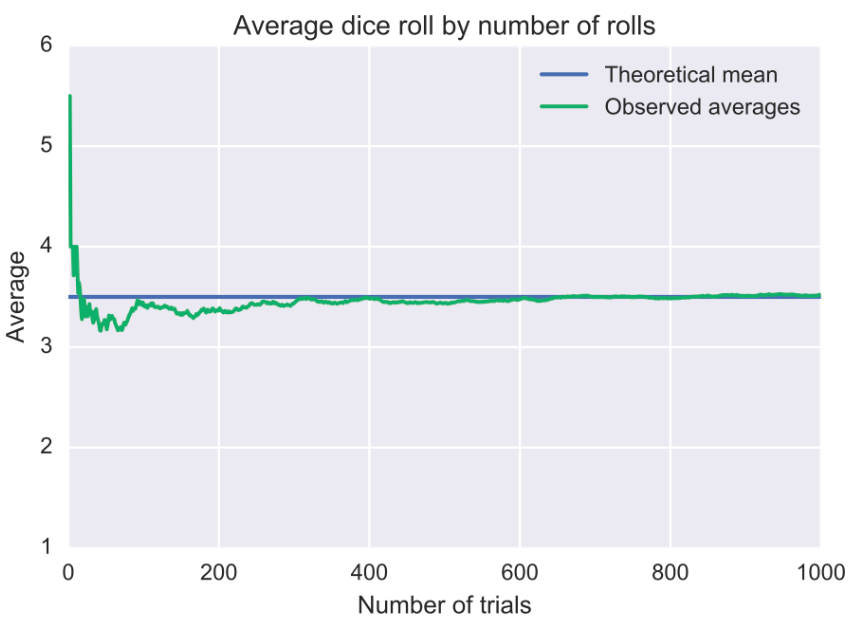

The Law of Large Numbers

What’s fascinated me with options trading is the same thing that Annie finds fulfilling in poker. It’s an environment in which we get the opportunity to make lots of decisions with quickly observed outcomes. Managing a real estate business is also a game where we get to make lots of little decisions with arguably even higher stakes. However the outcomes don’t always come as quick.

This is in my observation one of the greatest problems that agents face when it comes to choosing a strategy for growth. Lack of time and occurrences. It often takes more time and occurrences than agents are willing to invest to realize the desired results or see the theoretical mean.

Keep on Rolling

Let’s go through a little exercise where we can fast forward, and see how this movie ends.

Scenario: I’m going to give you 10,000 internet leads, and the rest of your career to convert them. Let’s just assume for some calculations that time frame is 25 years.

Now we’ll assume some various costs later, but for now assume these leads cost $15 dollars a piece.

Now it’s time for you to make a forecast. What % of these internet leads which indicated through their action some interest in buying or selling a home will actually do so over the next 25 years? 10%? 20%? 5%? Whatever number you decide upon that’s your potential opportunity.

Obviously we can’t capture 100% of the opportunities out there so let’s make another forecast on what is feasible. Out of 10,000 leads over the rest of your career what % do you think you could close? 3%? 2%? Maybe just 1%? Let’s low ball it, and take the 1%.

Alrighty so 1% conversion rate over the rest of our career. Assuming you sell homes at the current national avg price point of about $222,000; that nets you $6,660 in GCI (3% side) and let’s assume you give 40% of that away. Which leaves us with $2,664 bucks. I personally know that some of my readers don’t step foot out of their Mercedes for less than $10K in commission so i’m really slumming it up here.

10,000 leads * $15 dollars = $150K in advertising spend.

1% conversion rate of 10,000 = 100 closings.

100 closings * $2,664 dollars = $266,400 – $150K = $116,400

We’ve achieved a 77.6% Return on our investment!

None of these numbers are even remotely above average. In fact I’d call some of them rather piss poor. By giving 40% of our GCI away we’ve also accounted for a number of expenses here and still came out crushing it. So what gives? Why wouldn’t we make an investment like this with such a hefty return?

What makes life tough is we live it one agonizing or glorious moment at a time. We can look back at time anyway we please. We can think about whole decades. The 90’s for me were pretty much pogs, cargo pants, and bone thugs n’ harmony. But today I can just live one moment. The future is uncertain.

10,000 leads at $15 per pop divided evenly over 25 years looks like…

10,000/25 years = 400leads/12 months = 33 leads per month. Now think back to the charts above on the laws of large numbers. If after a month passes (33 leads), and we don’t see a conversion; one could understandably be nervous.

Consider however that 33 leads is only .0033 of the total lead volume (10,000). Variance from the mean is highly likely. Particularly when our win rate is only 1% over the long haul. Keep adding occurrences (leads) into the mix, and the law of large numbers shows that our results will become more reflective of our theoretical predictions.

Stay The Course: Be Consistent

So as you can see i’ve spelled out the guaranteed formula for success…

1. Spend money on leads

2. ????

3. Profit

Obviously phase 2 is kind of important. How we achieve our 1% or higher conversion rate might require a few more posts. (or you could just read my old ones. They’re ok) I can’t give you the magic formula for lead conversion, but if you’ve found something that does seem to be working here’s how we can realize our long term success. Be Consistent!

In trading we must be mechanical in our management, in poker we know when to fold ’em, and in real estate we must consistently do the things that improve our success. Every time you walk into a casino you’re playing a short game against the casino’s long one. The house has an edge. In Roulette you bet on a single number which pays 35-1. The odds? 37-1. Damn 00’s. All the free suites, and crab legs are designed to give the casino the thing that helps them win: Occurrences. If you keep playing you’ll most definitely lose in the long run.

In real estate, when we find an edge we must consistently implement that edge over as many occurrences as possible. This edge could be an increased response rate from texting instead of calling. Contacting leads when they engage with our website. Or as we performed in the example generating leads at a cost of $15 or less with a conversion rate of 1%. When we define our edge we need to keep using it. As Annie Duke puts it; don’t succumb to “Resulting” or a narrow zoom in perspective.

An example of this is to take a perfectly proven source of leads like Google or Zillow and exclaim. “This doesn’t work! These leads are low quality! I’m gonna try something else now. There’s no ROI here!” Again I would strongly encourage any agent to do the same math we did in this article. Don’t look back at the last 2 months of conversion rates and extrapolate a trend into the future. Consider the long term number of leads that could be generated, and forecast what your best and worst case scenarios could look like. This will likely give you the confidence you need. Does it guarantee success? Of course not. If you’re a hack on the phone, or not following up then there’s probably someone out there trying harder than you to pick up the slack.

TL:DR Summary

- Don’t be a “Resulter” Take control by becoming a better decision maker.

- Understand and estimate the long-term probabilities of success, and build a frame of reference around them

- Leverage The Law of Large Numbers: More occurrences will bring us closer to the theoretical mean.

- Be consistent: We must consistently use our edge, or whatever drives results for our business in order for the this reversion to the mean to become realized.

- Read these books!

- Superforecasting by Philip Tetlock & Dan Gardner

- Thinking in Bets by Annie Duke

- The Signal & The Noise by Nate Silver

- Watch Tasty Trade: A Financial Network

Recent Comments