I love a good twitter battle. Over the weekend one of my favorite people in Real Estate Steve Harney challenged Gary Vee to a little debate over a topic that’s really important to this industry. Home Ownership.

Click to see the Inman Article with Gary’s full comments.

I’m not even going to attempt to hide my bias here; I’m not a fan of people who post pictures of themselves with quotes of themselves.

But I do even in my own circles see this debate come up quite often, and thought it might fun for some of my readers who are over the age of knowing who most people were at the Grammy’s last night to see a perspective and personal story from a person who’s lived on both sides of the fence.

Real Estate Appreciation is a Poor Investment

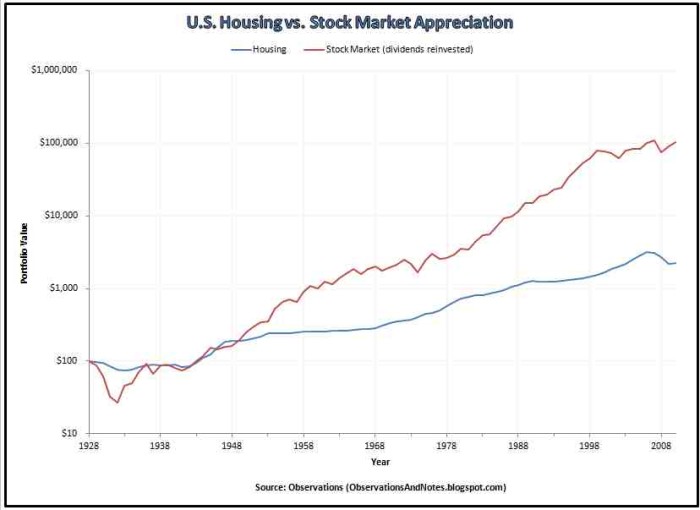

Here’s a chart I see over and over again in this argument. That money would be better invested in the stock market, because look at the graph!

Yes, if you buy a house in any town USA, and hold it for 100 years chances are the S&P will out perform the appreciation. As a very investment minded person this initially gave me a tremendous sense of pause. However once I educated myself throughly on the practice of real estate investing I found the comparison to be pineapples to parakeets.

What can make the conversation so confusing for people young, and old is that the word “investing” gets used in a very broad way in reference to real estate. Owning a real estate business is probably a better phrase that describes what people who make money in REI actually do. No matter what niche you operate in flipping, private lending, SFH rentals, multi-family, etc. what you find is the same thing that lies underneath every share of stock you own. A business. One that must generate more revenue that it has expenses, and is valued based on its ability to do so into the future.

I don’t think I’m going out on a limb to state that most retail investors who purchase stocks or Index ETF’s have any idea that the value of of the stocks within that index are derived from the calculated discount rate of the earnings of those companies; or that the rate of this discount can vary by the opinion of the person making the analysis. This being the case one should assume that the average non-real estate investor also doesn’t know how the game works!

It’s More Like a 401k Match

If your company offers you 100% match on 3% of your salary should you take it? The short simple answer is yes. You’re getting a 100% return with virtually no risk. Even if the investments in that 401k don’t perform particularly well in comparison to another investment you have the huge cushion of every dollar invested being matched assuming that’s all you invest.

When you “invest” in a property with leverage (a mortgage), and rent it out you now have someone paying that principal/interest down every month. Regardless of the appreciation of that asset the tenant is paying off the loan on the asset that you own. As Steve Harney, and many others far smarter than me have pointed out, when it comes to your living situation either you pay your own mortgage or someone else’s.

Money paid to interest goes to the bank. Money paid to principal converts into equity. The caveat of course is that equity is tied to the asset. This however isn’t as big of a hurdle as one would think. (enter the HELOC). This is something in my observation a lot of people could use some further education on. When you’re young, broke, and dreaming of bigger things it’s easy to focus on the return of the investment, and lose sight of the other side of the equation: Risk.

Money “invested” into a personal residence may not carry a large return in comparison to stocks, but it does provide some return in an asset that has shown long-term stability. Can the value of a home decline? I think we’re all still a little shell shocked from that reality, but like any investment including the stock market; we must understand that things can be over and under valued. As an agent even when it comes to clients who are purely emotional in their buying need; I strongly believe it’s your fiduciary responsibility to equip your clients with market data to help them understand this.

Leverage Is A Powerful Tool

If there’s one aspect of home ownership I think that scares my avocado loving generation more than anything it’s the idea of leverage gone wrong. Many of our parents borrowed too much, and paid dearly for it.

Already debt ridden in student loans I can see the hesitation to borrow. I myself was turned off from the idea of home ownership for this very reason for most of my 20’s. Why would I want to take that risk? Why would I want that ball and chain?

What Gary described in his video is exactly the life I was living. I was paying $850 per month (well below market rate) and living in an apt in a neighborhood with an average price range of $750K+. In my mind I was going to milk that deal forever. I can’t afford to buy here so i’ll just continue to rent at my cheap rate, and enjoy a higher standard of living than I can afford to own. (doesn’t that sound like borrowing?)

That plan literally went up in flames when my apartment burned down. Buh-bye $850 rent. Now I had a choice rent another place at $1400+ in the same hood or make a change. It was a few months before that I saw Steve speak and I learned something that I didn’t know… that buyers with good credit could obtain 3% down conventional loans. Previously I like many others was burned from the horror stories of 0% down undocumented income loans of the mid 00’s. I thought those products were for over-leveraged morons.

Quickly however I saw the potential. With a very SMALL amount of capital I could lock in a monthly payment on an asset over a long period of time. This is truly what turned me into a home owner. I didn’t have the lump sum of $$$ to put 20% down on most Charleston, SC area properties, but I certainly had 3%, and stable income with excellent credit.

Had I rented another apt it would’ve taken me a very long time to be able save enough money to make a > 20% payment on even a modest property. During that time the money spent on rent would’ve simply been gone. If I could purchase a home at a fair value with a monthly payment (including PMI) that was significantly less than what I would pay in rent then buying would make a lot of sense. Unfortunately what I had to do is something most people won’t: Compromise.

Buying a property with 3% down that was much cheaper than an apartment involved my girlfriend and I needing to look in places that we’re less than Ideal. We didn’t get a walk-in closet, or a lot of the features we wanted within our budget which was about 25% below the avg for the area. Eventually however we found something that worked. It wasn’t perfect, but it was ours. What influenced our decision to buy the home we bought was that we felt the property was undervalued, and the neighborhood appreciation to be on track for an above average trend. We happened to be right. (and more so than we ever thought) Our home appreciated at a rate that exceeded even our wildest expectations. Our modest $X,XXX downpayment turned into a very large return thanks to the power of leverage.

Does my success story warrant everyone going out and getting a 3% down loan? Of course not, but what people sitting on the fence really need to understand is that in business leverage is a tool. Credit is part of what makes the economy work. We should not be scared of leverage if it’s being used in a smart, and conservative way. Leverage allowed me to secure a lower monthly cost of living, and start putting some of those costs to equity instead of someone else.

Again this is where I think agents really need to bring a sense of fiduciary obligation to the table. One can easily borrow too much. One can surely use leverage to live a lifestyle that should be out of reach, and in doing so create an unacceptable profile of risk.

Be Responsible

While at Inman NYC ’19 this year I heard many luxury agents talk about repositioning themselves as financial advisors. Educating their clients on how their asset is performing. For those who don’t exclusively cater to the Viking appliances crowd; education on the power of leverage, the options available, and risks involved should be par for the course. This is going beyond “Don’t worry I know a lender who will approve you“

Explaining what a cap rate is should not be a conversation for just “Investor” clients or the rich. What Gary Vee is very spot on about is that the reasons many people DO go to college, and BUY homes is complete bullshit. They made that decision because that’s what they were told to do, and now they (we) are finding ourselves very skeptical as to why. Agents that are not educating their clients on the pro’s and con’s of leverage, how wealth can be created through ownership, and providing evidence driven pricing analysis are only contributing to screwing over a generation that already feels pretty gipped. Do the right thing, and strive to be better.

TL;DR

- Think Real Estate is a good investment? Educate people on how real estate investing actually works. Appreciation is a perk not the core appeal. Show them the math.

- Don’t be a door opener: This is typically the most expensive purchase a person will make in their life. Be their advisor. Show them the benefits, and the risks. Help them understand what a cap rate is and what it looks like with and without leverage.

- The Market is inefficient: As an agent you’re in one of the best positions to determine the market value of a property. Do so in an objective, and evidence driven way and you’ll gain a lot of trust as an expert advisor. Cater to the wants of what those with less information “think” and you’re only contributing to the low opinion the general public holds of agents.

- Do the right thing.

Recent Comments